How to Calculate 3 Types of Profit Margin in Excel

The Gross Profit Margin, Operating Profit Margin, and Net Profit Margin are all essential profitability indicators. They are frequently used to contrast the performance of the same company over time or between different companies. In this article, I will show you the processes to calculate the Gross Profit Margin, Operating Profit Margin, and Net Profit Margin in Excel.

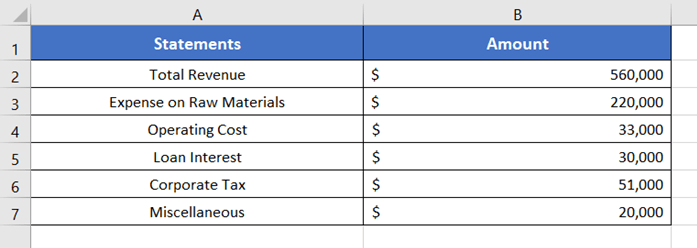

Before starting the procedure, let’s introduce you to our dataset for this article. Here is a list of the financial statements of a company (column A) and the mention of their corresponding cost (column B).

Below the data table, I will calculate the profit margins in a separate row.

Gross Profit Margin

What is Gross Profit Margin?

Gross Profit Margin is an economic ratio that calculates the percentage of profit a company makes from its total earnings. The Gross Profit Margin is helpful to measure a company’s financial health.

To calculate the Gross Profit Margin, subtract the total price of raw materials of a company from the total revenue. Then simply fractionate the result by the total revenue.

Calculate Gross Profit Margin in Excel

Now before showing you the method, I should mention that there is no built-in function for calculating the Gross Profit Margin in Excel. That’s why to calculate the Gross Profit Margin, we are going to follow the standard equation of Gross Profit Margin.

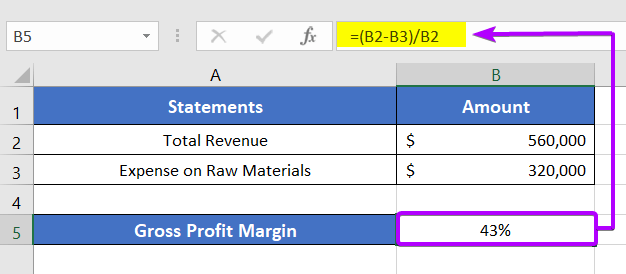

The formula to calculate gross profit margin, Gross Profit Margin= (Total Revenue – Expense on Raw Materials)/Total Revenue

So, the formula to apply in Excel for calculating gross profit margin is,

= (B2-B3)/B2Here,

- B2 indicates the value of Total Revenue.

- B3 denotes the total Expenses on Raw Materials.

To calculate gross profit margin in Excel, follow these steps:

- Select an empty cell.

To enter the formula, I’ll use cell B5. - Now, type the formula in cell B5.

- Press ENTER to insert the formula.

- Select cell B5.

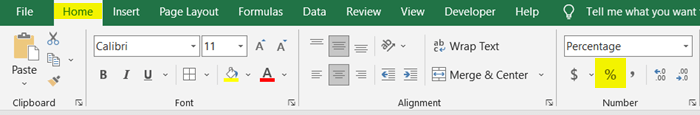

- Click on the Home tab.

- In the Number group, hit on the % button.

The Gross Profit Margin of our dataset is 43%.

Operating Profit Margin

What is Operating Profit Margin?

Operating Profit Margin is a measure of profitability that measures a company’s ability to generate profits from its core operations.

To calculate the Operating Profit Margin, first, deduct the total cost of operating costs and raw elements from the total revenue. Then fractionate the result of subtraction by the total revenue. Finally, express the result in percentage.

Calculate Operating Profit Margin in Excel

To calculate the Operating Profit Margin, only the cost of operating costs and raw elements are taken into consideration and they are subtracted from the total revenue.

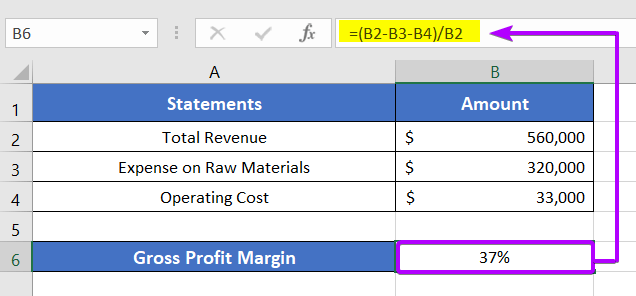

The formula to calculate operating profit margin, Operating Profit Margin = (Total Revenue – Expense on Raw Materials – Operating Cost)/ Total Revenue

The formula to apply in Excel to calculate operating profit margin,

= (B2-B3-B4)/B2Here,

- B2 indicates the value of Total Revenue.

- B3 is the Expenses on Raw Materials.

- B4 represents the Operating Cost.

To calculate the operating profit margin in Excel, follow these steps:

- Select an empty cell.

I will be using cell B6 to insert the formula. - Write the formula in cell B6.

- Press ENTER.

- Click on the % icon in the Number group of the Home tab.

Normally, the Operating Profit Margin is represented in percentage form. So, it is best to use the percentage (%) here.

Net Profit Margin

What is Net Profit Margin?

Net Profit Margin expresses the amount of net income or profit generated as a percentage of revenue. The Net Profit Margin calculates the percentage of revenue that remains after all operating and non-operating expenses like debts, interests, and taxes, etc. have been paid.

Calculate Net Profit Margin in Excel

The Net Profit Margin considers all types of expenses for its calculation.

The formula to calculate net profit margin, Net Profit Margin= = (Total Revenue – Expenses on Raw Materials – Operating Cost – Other Expenses)/Total Revenue

To apply this formula in Excel,

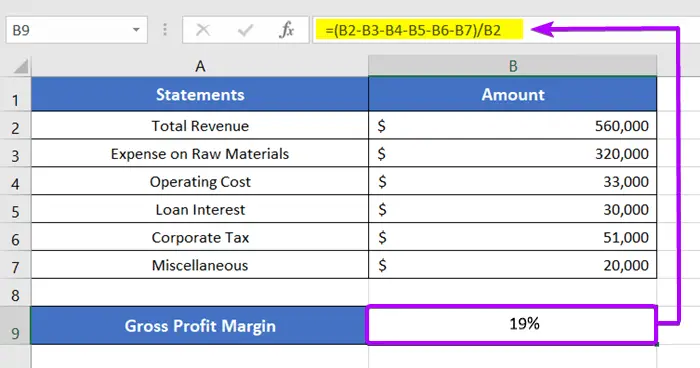

=(B2-B3-B4-B5-B6-B7)/B2In the above formula,

- B2 is the inflow of money. It is the total amount of revenue.

- B3, B4, B5, B6, and B7 are different sorts of outflow of revenue.

To calculate net profit margin in Excel, go through the steps below:

- Type the formula in an empty cell.

I’ve inserted the formula in cell B9. - Write the formula in cell B6.

- Press ENTER.

- Now hit the % icon under the Number group of the Home tab.

So, you can see all types of expenses are subtracted to find the Net Profit Margin. Here I have to mention that, the additional expenses can vary in other cases.

Conclusion

I hope now you have a clear concept of the 3 types of profit margin calculation in Excel. I hope this article will help you to solve any sort of situation regarding profit margin. Please visit our Blog page for more Excel-related articles like this one. Feel free to share your thoughts about our articles in the comment section below. Thank you!

Frequently Asked Questions

How do you do margins in Excel?

To set margins in Excel, follow these steps:

- Click on the Page Layout tab in the Excel ribbon.

- In the Page Setup group, click on Margins.

- Select one of the predefined margin options (Normal, Wide, Narrow) or click on Custom Margins for more control.

- If you choose Custom Margins, a dialog box will appear. Enter the desired margin values for the top, bottom, left, and right margins.

- Click OK to apply the selected margins to your Excel worksheet.

Setting margins in Excel is essential for controlling the layout when printing or previewing your spreadsheet. Adjusting margins helps ensure that your data is appropriately formatted on the printed page.

How to calculate profit in Excel?

To calculate profit in Excel, use the formula: Profit=Revenue−Expenses

Here’s a step-by-step guide:

- In your Excel worksheet, input the revenue value in one cell (e.g., A1) and the expenses in another cell (e.g., B1).

- In a new cell, enter the formula: =A1- B1. This subtracts expenses from revenue to calculate profit.

For example, if your revenue is $50,000 (in cell A1) and expenses are $30,000 (in cell B1), the formula =A1-B1 will give you a profit of $20,000.

This simple formula enables you to quickly determine profit in Excel by subtracting total expenses from total revenue.

Related Articles

- How to Calculate Total Revenue in Excel [Free Template]

- How to Calculate Profitability Index in Excel [Free Template]

- How to Find Interquartile Range (IQR) in Excel [Free Calculator]

- 2 Ways to Calculate Cumulative Frequency in Excel

- Calculate Percentage of a Number in Excel [4 Cases Explained]

- 2 Ways to Calculate Percentage Increase in Excel