How to Calculate Dividend Per Share in Excel [Step-by-Step]

Dividend Per Share (DPS) is a crucial financial metric that provides insights into a company’s dividend distribution to its shareholders. Calculating DPS in Excel can be a straightforward process if you follow a step-by-step approach. In this guide, I’ll break down the process into easy-to-follow steps, ensuring accuracy and efficiency.

What is Dividend Per Share?

Dividend Per Share (DPS) is a financial metric that represents the amount of cash a company distributes to its shareholders in the form of dividends on a per-share basis. It is calculated by dividing the total amount of dividends paid by the number of outstanding shares of the company’s stock.

The formula for Dividend Per Share (DPS) is:

DPS = Total Dividends Paid / Number of Outstanding Shares

The result is the dividend amount that each shareholder would receive for each share they own. Dividends are typically paid out periodically, such as quarterly or annually, and they are a way for companies to share their profits with shareholders.

Investors often look at DPS as an important indicator of a company’s financial health and its willingness and ability to reward shareholders with a portion of its earnings. However, it’s important to note that a high DPS alone does not necessarily make a stock a good investment, as other factors such as the company’s overall financial performance, growth prospects, and dividend sustainability should also be considered.

Steps to Calculate Dividend Per Share in Excel

Understanding how to calculate Dividend Per Share (DPS) is essential for investors and financial analysts to assess a company’s dividend distribution efficiency. By leveraging the capabilities of Excel, you can streamline this process and obtain accurate DPS figures for different scenarios. In this guide, we’ll walk through the steps, ensuring a user-friendly approach to help you effortlessly navigate the world of financial calculations.

Step 1: Prepare Dataset in Excel

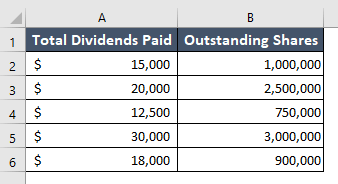

This step involves providing sample data that mimics real-world scenarios. Below is an example dataset that you can use for your guide:

- Enter the dataset into the worksheet.

- Place the “Total Dividends Paid” values in column A (A2 to A6) and the “Outstanding Shares” values in column B (B2 to B6).

This column ”Total Dividends Paid” represents the total amount of dividends distributed by a hypothetical company in various situations. The “Outstanding Shares” column provides the total number of outstanding shares held by investors for the corresponding scenario in the “Total Dividends Paid” column.

Step 2: Calculate Dividend Per Share

To calculate the dividend per share, go through the steps below:

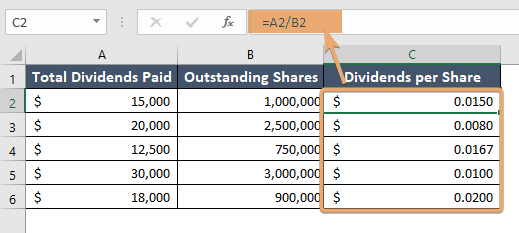

- In an empty cell, enter the formula to calculate DPS.

- Use the formula: =A2/B2

This formula divides the total dividends paid by the number of outstanding shares for the first scenario. - Press ENTER.

- Click on the lower-right corner of cell C2 (where a small square, known as the fill handle, appears) and drag it down to fill the formula for the entire column.

This will automatically calculate the DPS for each scenario. To enhance readability, you can format the cells in column C containing the DPS values. Right-click on the column header (C) or the specific cells, select “Format Cells,” and choose the desired number format (e.g., currency format) for the DPS values.

Conclusion

Calculating Dividend Per Share in Excel is a fundamental skill for investors, providing a clearer picture of a company’s dividend distribution. This guide aims to simplify the process, making it accessible to individuals with varying levels of financial expertise. By following these steps, you’ll be equipped to leverage Excel for insightful financial analysis and investment decisions. Unlock the power of DPS and enhance your financial acumen today!

Frequently Asked Questions

What is the formula of dividends?

The formula for dividends is: Dividends=Dividend per share*Number of shares

This formula calculates the total amount of dividends paid by a company. The “Dividend per share” is the amount of money paid to each shareholder for each share they own, and the “Number of shares” represents the total shares outstanding.

It’s important to note that dividends can be declared and paid in different ways, such as cash dividends or stock dividends. The formula above is a general representation, but the specific terms may vary based on the company’s dividend policy.

What are the 4 types of dividends?

The four types of dividends are:

- Cash Dividends: Cash payments made to shareholders from a company’s profits.

- Stock Dividends: Distribution of additional shares to existing shareholders.

- Property Dividends: Non-cash assets distributed to shareholders as dividends.

- Special Dividends: One-time payments made by a company, often due to extraordinary profits or events.

These dividend types represent different ways companies can distribute profits to their shareholders.